Discover Tax-Free States: Where Social Security Benefits Are Untaxed

Discover Tax-Free States: Where Social Security Benefits Are Untaxed

Understanding the Impact of No State Tax on Social Security

The absence of state taxes on Social Security benefits can significantly influence retirees’ financial well-being. For individuals living on a fixed income, such as Social Security, every dollar counts. States that choose not to tax this source of income are essentially providing their residents with a buffer against financial strain, allowing them to allocate their limited resources more effectively. This approach not only supports individual livelihoods but also fosters a more favorable retirement climate, attracting seniors who seek to maximize their savings and enjoy a more comfortable lifestyle.

List of States with Favorable Tax Policies

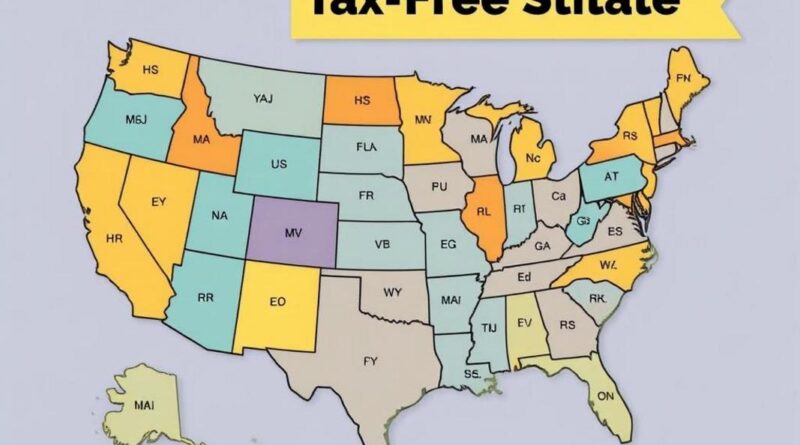

Currently, there is an impressive roster of 41 states that do not impose taxes on Social Security benefits. This diverse array of states includes both popular retirement destinations and lesser-known locales. From the sunny beaches of Florida to the serene landscapes of Montana, these states present appealing options for retirees looking to stretch their dollars further. Exploring the geographical and economic variety among these tax-free havens can also reveal unique community cultures and amenities, enriching the overall retirement experience.

Why Some States Tax Social Security Benefits

Interestingly, some states do choose to tax Social Security benefits, often citing budgetary needs or a desire for a more balanced tax system. This can be a contentious issue among residents and lawmakers, as it raises the question of fairness versus fiscal responsibility. While these tax policies may aim to generate additional state revenue, the potential downside may include dissuading retirees from settling in or remaining in those states, leading to demographic challenges as populations age. Understanding the motivations behind these decisions provides vital context for voters and policymakers alike.

The Economic Benefits of Retaining Retirees

States that exempt Social Security benefits from taxation not only benefit their residents but also bolster their own economies. By attracting retirees, these states can enhance local businesses, boost consumer spending, and foster community engagement. Seniors tend to spend their Social Security income in local establishments, supporting jobs and contributing to a vibrant economic ecosystem. As a result, these tax incentives may serve as strategic investments in the long-term health of the state’s economy, creating a win-win scenario for both the government and its residents.

Final Thoughts on Tax-Free Retirement Living

The choice of where to retire is often influenced by multiple factors, with state tax policies playing a pivotal role. Each retiree’s situation is unique, and understanding the implications of Social Security taxation can help individuals make informed decisions about their futures. You can read more from the original source here. As you contemplate your retirement options, consider how tax policies not only affect your finances but also shape the community you’ll be part of—what does your ideal retirement look like?

Understanding the Impact of No State Tax on Social Security

List of States with Favorable Tax Policies

Why Some States Tax Social Security Benefits

The Economic Benefits of Retaining Retirees

Final Thoughts on Tax-Free Retirement Living